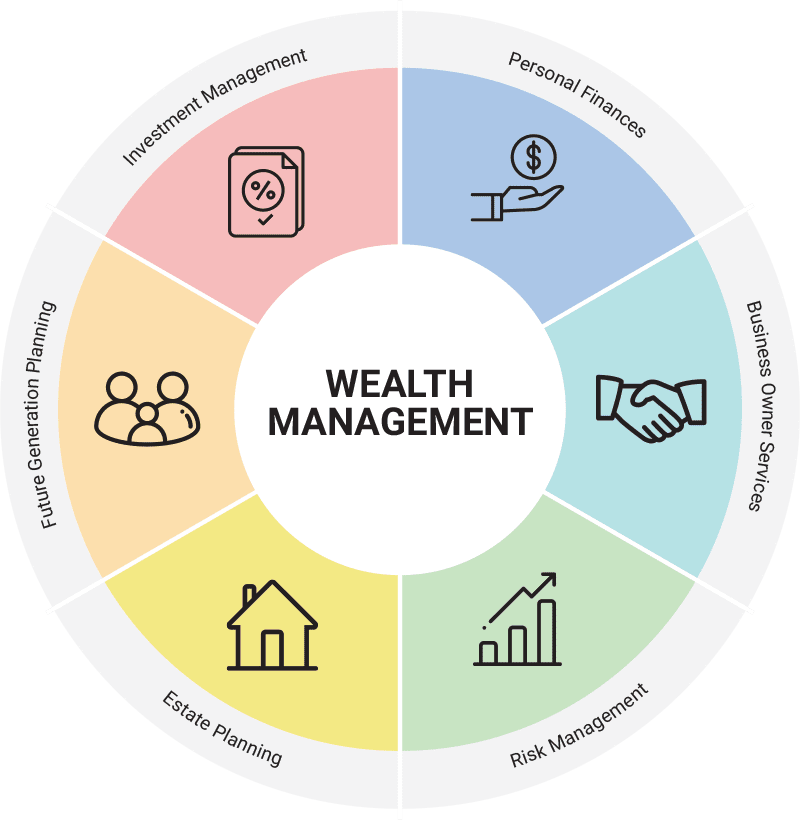

Wealth management is the process of integrating portfolio management with other financial services to address the needs of high net worth clients. Each client’s wealth management needs are different. Some merely need help organizing their thoughts so an attorney can efficiently draft their estate plan. Others have more complex needs that may require planning in the areas of personal finance, prenuptial/divorce, or business succession. A select group may have highly specialized needs related to the acquisition of an aircraft or a sudden life event requiring coordination with outside professionals.

We believe exceptional service begins by developing a meaningful relationship with each client, truly understanding what is important today and for the next generation of that client’s family. With more than two decades of experience, a deep internal knowledge base, and a network of trusted professionals, we can assist with an array of services as unique and diverse as the clients we serve.

Investment Management

- Fiduciary-level Advice

- Long-term Investment Horizon

- Internal Research / Management

- Private Investments

Personal Finances

- Personal Balance Sheet

- Budget & Financial Calculations

- Financing Analysis

- Liquidity + Cash Reserves

Business Owner Services

- Collaborate to Maximize Business Value (Today / Future)

- Succession Planning

(Generational or Third Party) - Due Diligence

- Retirement Plan Options

- Financing / Re-capitalization

Risk Management

- Divorce/Prenuptial Planning

- Insurance Needs Analysis

- Legal Consultation

Estate Planning

- Education

- Estate Plan Review

- Beneficiary Review

- Gifting Strategies

Future Generation Planning

- College and Education

- Trust and Legacy Planning

- Wealth Transfer and Gifting